These filter stocks based on the size and direction of the stocks gap. Buying a put option is a bet on less Selling is a bet on more.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

. A stock market equity market or share market is the aggregation of buyers and sellers of stocks also called shares which represent ownership claims on businesses. A stock derivative is any financial instrument for which the underlying asset is the price of an equity. Buying on margin refers to the initial or down payment made to the broker for the.

The loan in the account is collateralized by the securities and cash. The dotcom bubble occurred in the late 1990s and was characterized by a rapid rise in equity markets fueled by investments in Internet-based companies. Economic order quantity EOQ is an equation for inventory that determines the ideal order quantity a company should purchase for its inventory given a set cost of.

Of course for every buyer there must have been a seller so use these with caution. The World Trade Organization WTO is an intergovernmental organization that regulates and facilitates international trade. An ETF or exchange-traded fund is a marketable security that tracks an index a commodity bonds or a basket of assets like an index fund.

The amount by which one thing is different from another. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. Economic Order Quantity - EOQ.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time price and volume. A futures contract is a legal agreement generally made on the trading floor of a futures exchange to buy or sell a particular commodity or financial instrument at a. In the twenty-first century algorithmic trading has been gaining traction with both retail and.

During the dotcom bubble the. It also refers to the amount of equity. These may include securities listed on a public stock exchange as well as stock that is only traded privately such as shares of private companies which are sold to investors through equity crowdfunding.

Understanding Margin - Buying Stock vs. Get all the latest India news ipo bse business news commodity only on Moneycontrol. This balance can be used to purchase securities that dont allow for borrowing against them ie those that have 100 margin requirement.

An example of a Margin Scheme stock book is included at section 6. You cant however purchase options on margin - call or puts - as options. Margin is the difference between a product or services selling price and its cost of production or to the ratio between a companys revenues and expenses.

The broker usually has the right to change the percentage of the value of each security it will allow towards. Stock futures are contracts where the buyer is long ie takes on the obligation to buy on the contract maturity. Buying a call is typically a bullish move so we draw an arrow pointing up.

This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. Exchange-Traded Fund ETF. This is basically a loan from your broker which your broker will charge you interest for.

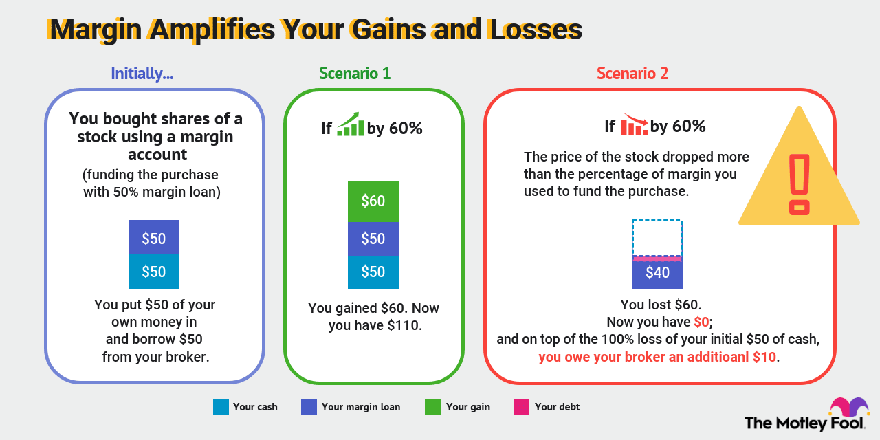

And since these are loans youll have to pay interest on them. A margin account is a brokerage account in which the broker lends the customer cash to purchase securities. So if you want to use margin to buy 5000 worth of stock you have to put down at least 2500 if you want to borrow the rest to make the purchase.

Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. First you can buy stock on margin or purchase more shares than you literally have the cash for. Futures and options are the main types of derivatives on stocks.

Gross margin -- also called gross profit margin or gross margin ratio -- is a companys sales minus its cost of goods sold COGS expressed as a percentage of sales. The margin schemes and buying and selling within the EU and Northern Ireland. This balance uses your cash and margin surplus from any margin-eligible securities already in the account which means you can create a margin loan and borrow against those other.

See My Options Sign Up. The customer has five business days to meet his or her margin call during which the customers day trading buying power is restricted to two times the customers maintenance margin excess based on the customers daily total trading commitment for equity securities. The profit made on a product or.

The funds available under the margin loan are determined by the broker based on the securities owned and provided by the trader which act as collateral for the loan. Broker-dealer will issue a day trading margin call. The question in an options trade is.

A margin account is a loan account with a broker which can be used for share trading. Margin can be used in a couple of very different ways. Buying a put is typically a bearish move so our icon for this points down.

It officially commenced operations on 1 January 1995 pursuant to the 1994 Marrakesh Agreement thus replacing the General Agreement on Tariffs. Unlike mutual funds an. Generally margin loans.

Governments use the organization to establish revise and enforce the rules that govern international trade. A margin call is a broker s demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the minimum maintenance margin. The underlying security may be a stock index or an individual firms stock eg.

21 The definition of a Margin Scheme. Put another way gross margin. What will a stock be worth at a future date.

Under margin trading rules you could buy twice as much stock than you can actually afford.

Buying On Margin Definition Examples Top 4 Types

What Is Margin In Trading Meaning And Example

0 Comments